Silkpay payment and refund solutions for travel agencies

Cover designed by Freepik

The travel industry runs on speed, flexibility, and trust.

Whether it’s last-minute bookings or managing high volumes of cancellations, travel agencies face constant pressure to deliver smooth and reliable payment experiences.

Silkpay is designed as an end-to-end payment solution that meets these demands, helping agencies satisfy global travelers.

Key challenges in travel payments and refunds

Multiple payment channels

Travel agencies typically deal with a mix of online bookings, walk-in customers, and mobile interactions (such as payments through travel apps or tour guides in the field).

Without a unified system, these channels often operate in silos:

Online systems may connect to a separate gateway from in-person POS devices.

Walk-in customers may pay via QR code or credit card, requiring manual reconciliation.

Mobile transactions during tours (e.g. on-the-go upgrades, souvenirs) are difficult to track alongside bookings.

Impact: Reconciling transactions from multiple sources becomes time-consuming, error-prone, and can lead to mismatched or lost data.

Delays in confirming payments, especially for last-minute bookings

In travel, time is critical, especially for:

Last-minute bookings, such as same-day excursions, airport transfers, or hotel check-ins.

High-demand experiences where slots are limited.

Many systems take minutes or even hours to verify a payment. If confirmation isn’t immediate:

Customers may walk away or lose interest.

Agencies may have to manually follow up, causing delays and confusion.

Manual refund processes that frustrate both staff and customers

Refunds in the travel industry are frequent and often unavoidable, triggered by events such as flight delays, sudden weather disruptions, or changes in itinerary and visa approvals.

However, many agencies still rely on outdated methods like manual bank transfers or separate systems to handle these refunds.

This process typically involves logging into multiple platforms, verifying the customer's identity and booking details, and manually re-entering transaction information, each step introducing delays and potential for error.

As a result, even a single refund can take 15 to 30 minutes to process. It will cause longer queues, increased administrative burden, and a frustrating experience for both staff and travelers.

Difficulty supporting preferred payment methods for tourists

Asian and other international travelers increasingly prefer using mobile wallets such as Alipay, WeChat Pay, KakaoPay, UnionPay, GCash, Touch 'n Go, and GrabPay for their convenience and familiarity.

However, many traditional travel agencies still only support Visa, Mastercard, or local debit cards. This creates a disconnect between customer expectations and available options.

This gap often forces tourists to search for ATMs or use unfamiliar payment methods, which can lead to abandoned purchases and a decline in overall satisfaction.

Limited tools for managing secure, same-day cancellations or partial refunds

Standard payment processors often fall short when it comes to handling the specific refund needs of travel agencies.

They typically lack support for same-day refunds, partial refunds (such as canceling one item in a package), or instant reimbursements to the original payment method.

In these cases, agencies often use manual bank transfers. Sometimes, they escalate the issue to customer service teams. These processes take a lot of time. They can also cause miscommunication and data entry errors.

With no real-time visibility into the refund status, both staff and customers are left in the dark, leading to weakened trust, slower resolution, and increased workload for agency teams managing exceptions.

How Silkpay solves these problems

Unified payment platform

Silkpay supports global payments through a wide range of methods, including:

Alipay+: Reach over 1 billion users with access to 16+ Asian e-wallets such as GCash, Touch 'n Go, and GrabPay

WeChat Pay, UnionPay, Visa, Mastercard, and more

All transactions are visible in one dashboard, ensuring better control and easier tracking.

Flexible payment methods

PaybyLink:

If you don’t have the resources for a full API integration, or if you have no website but still want to sell your service online or on your booking platform, PaybyLink is the best alternative.

You can generate secure payment links through Silkpay backoffice and send them to customers via email, SMS, or chat apps.

Customers then click on the link to complete the payment using their preferred payment methods.

Wireless POS terminal (PAX A920 Pro):

For agencies looking for an in-store payment solution, Silkpay offers the latest model and the most performant POS terminal: The Pax A920 pro that supports e-wallets, QR code scanning, card payment and contactless payments.

Our PAX A920 Pro payment solution allows merchants to receive Alipay+, WeChat Pay, and other major payment methods such as Visa, Mastercard, Google Pay, Apple Pay and UnionPay.

Additionally, it’s wireless. With Pax A920 pro, you can start accepting payments even in pop stores or exhibitions.

QR code payments:

Silkpay also allows merchants to accept payment in-store through a static QR code solution.

We provide a printed QR code that can be placed at the checkout counter, enabling customers to simply scan it with their mobile wallet to complete the payment in a few seconds.

This in-store solution includes a dedicated Alipay+, WeChat Pay, and UnionPay QR code. It's easy for merchants to offer a convenient and familiar payment method to Asian customers.

Alipay+ supports more than 16 Asian e-wallets, including Alipay from China, KakaoPay and Naver Pay from South Korea, Boost from Malaysia, GrabPay from Singapore, and many more, so Asian customers can simply scan your Alipay+ static QR code to pay in-store with their preferred local wallet.

API:

For businesses looking for complete control over their online payment process, API integration is the best option.

APIs with our payment solutions that allow direct integration with your website or application.

This method provides full customization of the checkout experience and ensures a seamless transaction process.

Additionally, our technical support team is always available to assist with integration.

Autonomous refund process

Silkpay’s built-in refund feature allows agencies to:

Initiate refunds through your Silkpay’s backoffice

Process same-day, partial, or full refunds, reducing administrative burdens

Improve customer satisfaction with fast and transparent handling

Transaction refunds through Silkpay’s back office and POS terminal.

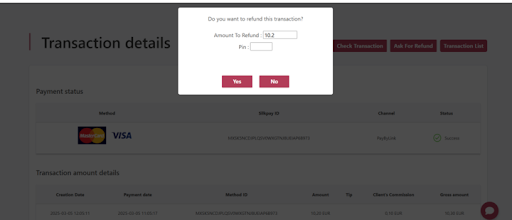

Refunding a transaction via back office:

Select the transaction you want to refund

Click “Ask to refund.” on the right top.

Enter the amount to be refunded

Enter your PIN code

Click “Yes” to confirm

The refund will be processed successfully.

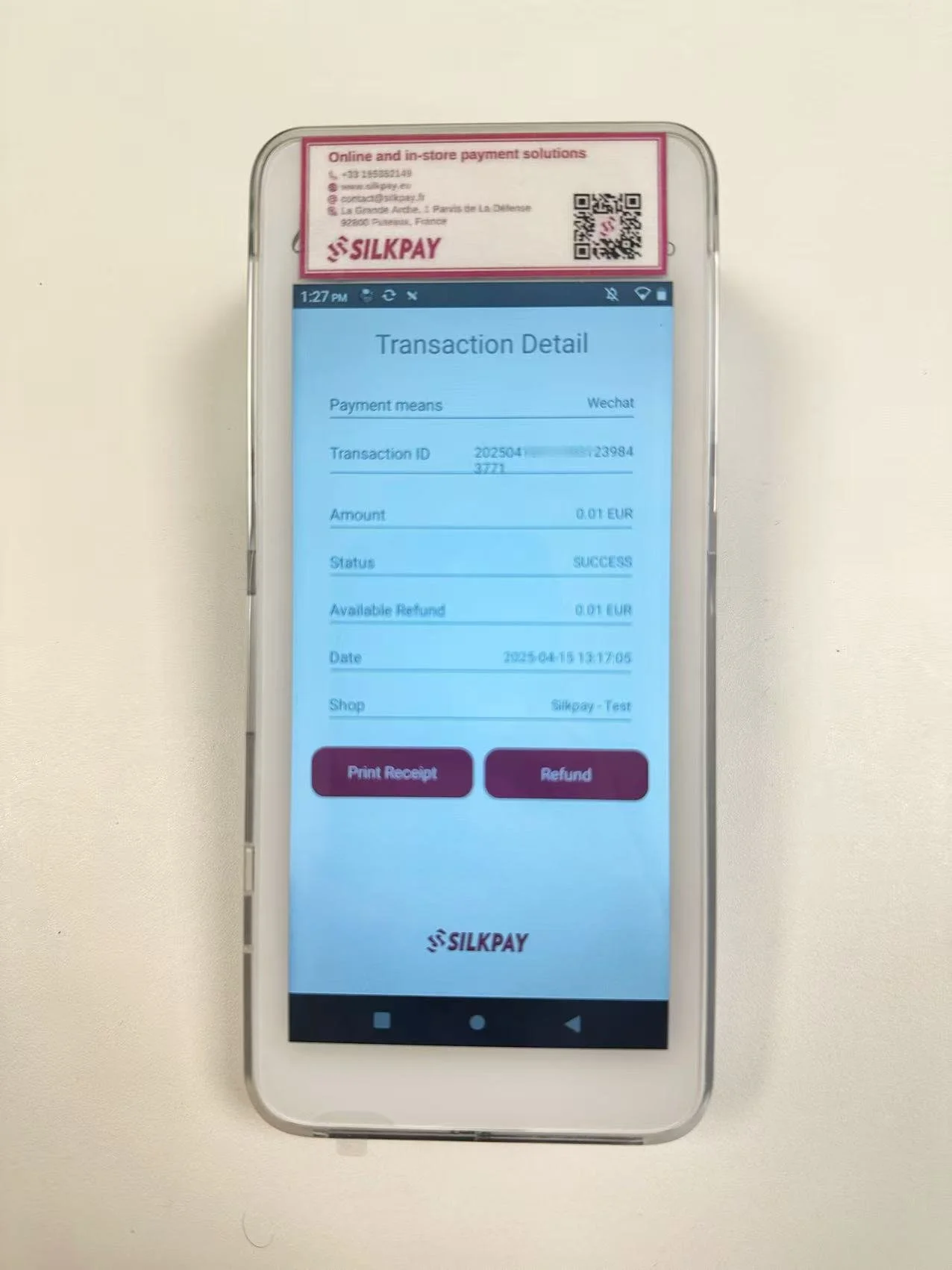

Refunding a transaction via POS terminal:

Select the transaction you want to refund.

Click the “Refund” button below.

Enter the amount to be refunded.

Enter your PIN code.

Click “Yes” to confirm.

Fast, trackable, and secure, without needing to involve external banks

Reduce admin load while improving customer satisfaction

Benefits for travel agencies

Faster bookings with real-time payment confirmation

In the travel industry, timing is everything, especially for last-minute bookings or time-sensitive services like airport transfers and guided tours.

With Silkpay’s real-time payment confirmation, agencies can instantly verify transactions and confirm bookings without waiting for delayed bank approvals.

This speeds up the booking process, reduces uncertainty, and allows agencies to serve customers faster and more efficiently.

Fewer lost sales due to complicated transfers

Traditional payment systems often involve multiple steps, third-party banks, or manual coordination, which can discourage customers from completing their bookings.

With Silkpay, the process is streamlined, once the payment is confirmed, the agency will get an email or can check the completed transaction in their Silkpay’s backoffice.

By making payments quick and simple, agencies reduce drop-off rates and capture more revenue that would otherwise be lost to complicated or unclear payment flows.

Seamless experience for both tourists and staff

Silkpay’s unified platform offers a consistent and intuitive interface for processing payments, issuing refunds, and managing bookings.

Staff no longer need to juggle multiple systems or manually cross-check transactions.

Tourists benefit from a fast, secure, and user-friendly experience, whether they are paying online, via QR code, or in-person.

The result is less confusion, fewer errors, and a more professional service overall.

Stronger appeal to Asian travelers with familiar payment methods

Asian travelers, especially from countries like China, South Korea, and Malaysia, prefer using mobile wallets such as Alipay+, WeChat Pay, and UnionPay.

Silkpay integrates over 16 regional e-wallets through Alipay+, and helps merchants accept the payment methods they’re used to.

This not only builds trust but also increases the likelihood of completing purchases, and gives you a competitive edge in attracting high-spending international tourists.

Full visibility into all transactions and refunds in one place

With Silkpay’s centralized dashboard, agencies can monitor all payment activity in one place.

This includes real-time tracking of transactions, automated refund processing, and detailed financial reporting.

Agencies gain better control over cash flow, simplify reconciliation, and reduce the risk of errors.

The ability to manage both payments and refunds from a single system improves efficiency and gives decision-makers the visibility they need to optimize operations.

Conclusion

In a fast-moving and competitive industry like travel, efficiency, trust, and customer satisfaction are essential.

Silkpay empowers agencies with a comprehensive, flexible, and user-friendly payment and refund solution tailored to the needs of global travelers.

From multiple payment acceptance to real-time confirmations and simplified refund processes, Silkpay helps travel businesses reduce friction, boost revenue, and deliver a better experience for both staff and tourists.

With Silkpay, you are not just keeping up, you are staying ahead.

About the author: Silkpay

Based in Paris, Silkpay provides omnichannel and secure payment solutions to help physical stores and e-commerce in Europe and the Americas accept more than 30 of the world's most popular payment methods: Visa, Mastercard, CB, UnionPay, Alipay+, WeChat Pay as well as Asia-Pacific’s major e-wallets.

Silkpay is a winner of the LVMH Innovation Award. The company was also selected as a finalist for the "Money 20/20" Best Startup and in the "MPE Berlin” Startup Awards. Silkpay also won the "Best Fintech" awards from Capgemini and BPCE.

Silkpay helps merchants deliver the smoothest payment experience to their customers. We are a talented and international team driven by a single goal: to improve the customer experience and make payments simple and secure.